THE REVOLVING FUND

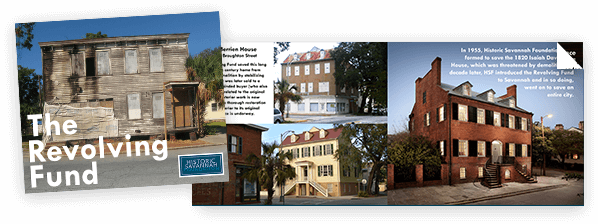

At HSF, we unapologetically say, “the Revolving Fund is the program that saved Savannah.” It is our primary tool for saving and protecting endangered, blighted, historic properties. In truth, the organization was founded to save just one house, the 1820 Isaiah Davenport House, but went on to save an entire city.

“It is our primary tool for saving and protecting endangered, blighted, historic properties.”

The Revolving Fund privately raises money, which is then used to purchase vacant, blighted, and endangered historic properties. HSF cleans them up, stabilizes and secures them if necessary, and then conducts a search for a preservation–minded buyer. Requests for Proposals (RFP’s) are solicited, and the buyer is selected based on the best proposal submitted. A Revolving Fund committee of nine professionals including preservationists, architects, contractors, realtors, and lawyers makes the final determination. Each property is ultimately sold with a preservation easement attached to the deed to protect it in perpetuity. The money from the sale goes right back into the Revolving Fund to purchase the next property, and the cycle repeats itself. To date, HSF has saved and protected 420 properties using both the Revolving Fund and easements.

Since its inception, the HSF Revolving Fund has become one of the most respected programs of its kind. Early on, it became the model that many other cities across the country adopted as the basis for their own program.

Click here to see all available properties for sale.

CRITERIA

HSF uses a set of criteria to determine if a property is a good fit for the Revolving Fund.

Vacant– the building has not been inhabited for some time.

Endangered– the building suffers from long-term neglect or imminent danger of being demolished.

Located in a target area– HSF uses its resources in the neighborhoods that could benefit the most from the additional investment.

THE REVOLVING FUND CAN HELP THROUGH…

THE PROCESS

Acquisition

The Revolving Fund purchases the property from the owner, or their heirs, after negotiating an acceptable price and terms.

Clean-up/Stabilization

After acquiring the property, HSF organizes a volunteer cleanup to remove trash and debris from the premises. HSF also uses this opportunity to secure and stabilize the property in order to prevent any further damage or deterioration. After the property is clean and safe, HSF holds an open house for the public.

Sell/Restore

The Revolving Fund conducts a search for a qualified, preservation–minded buyer who will agree to restore the property within a reasonable time frame. Occasionally, HSF will execute a full restoration before selling a property, but the former method frees up funds to acquire other buildings in desperate need of saving.

Sale/Easement

At the time of sale, a preservation easement is placed on the property, giving HSF oversight of all repairs, alterations, and improvements to the exterior of the building as well as certain interior elements.

REVOLVING FUND

Check out our illustrated pocket-guide to the HSF Revolving Fund.